DATAFLOW™

No-Code Verification in Seconds

Helping banks work better.

With our drag-and-drop DataFlow Solution, banks can securely and confidently design and deploy customized identity verification workflows in real time - no developers required.

POWERED BY DATAFLOW

Complete verification ecosystem in one platform

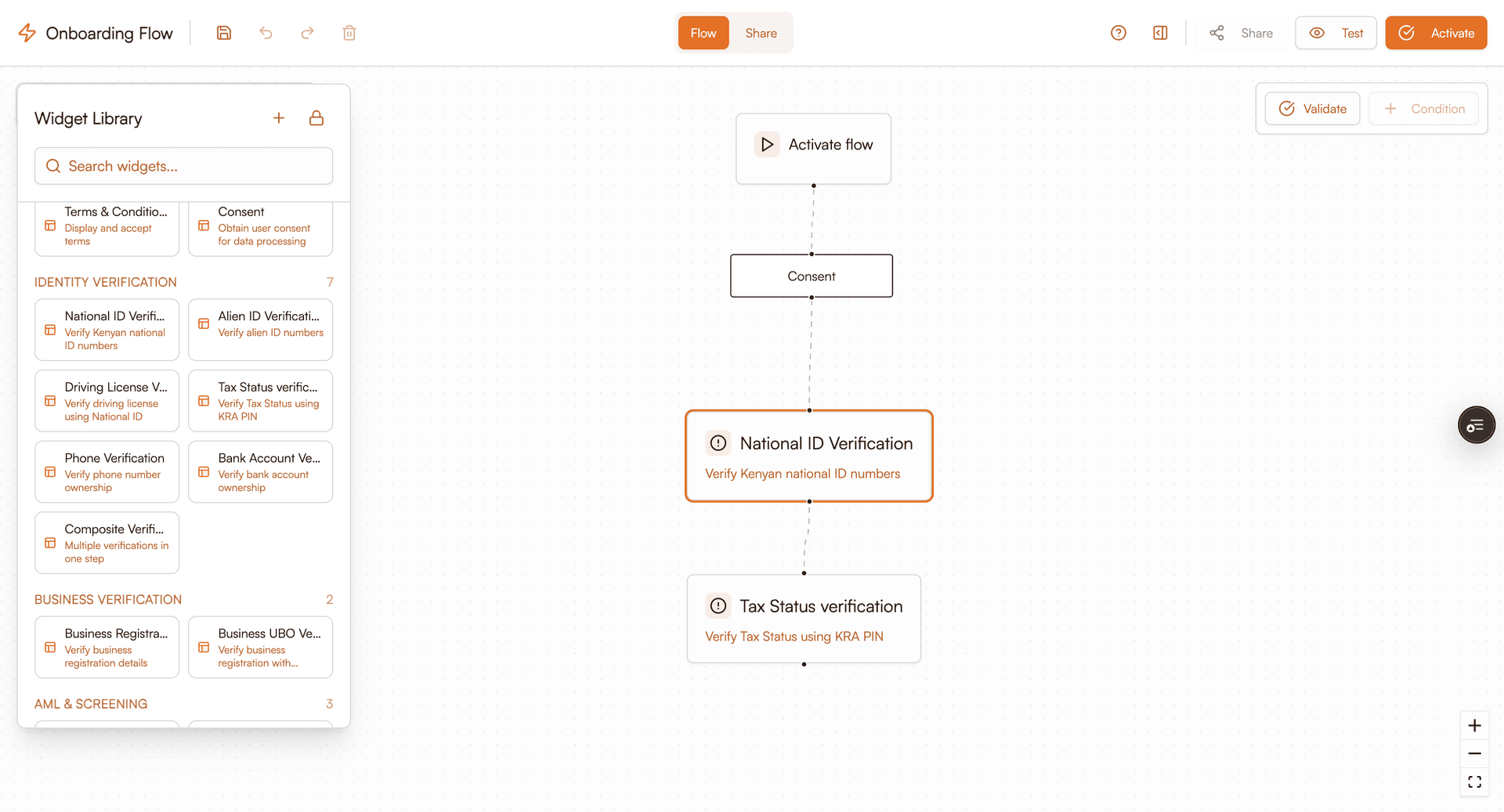

No-Code Verification Builder

Design custom verification workflows with drag-and-drop simplicity. Build complex KYC processes in minutes, not months - no developers required.

OUR USECASES

Securing digital interactions across diverse industries in Africa

From fintech startups to established banks, we provide tailored verification solutions that meet the unique needs of every industry across the African continent.

Banking

Streamlined customer onboarding

Lending

Data-driven lending decisions

Fraud & Risk

Advanced fraud detection

Customer Onboarding

Seamless digital onboarding

DATA COVERAGE

Comprehensive data coverage across the African continent

Access the most extensive database of verified African data, powering accurate identity verification and business intelligence across 12+ countries.

Security & Compliance

At Identify Africa, we prioritize the highest standards of security and compliance to safeguard your operations and protect user data. Our robust measures ensure adherence to global regulatory frameworks, providing peace of mind in an ever-evolving digital landscape.

Regulatory Adherence

Stay compliant with stringent international and local regulations, including GDPR, CCPA, and industry-specific standards.

Data Protection

Implement advanced encryption protocols and secure storage solutions to protect sensitive user information.

FREQUENTLY ASKED QUESTIONS

Need Help? Find Answers Here

DataFlow is our no-code drag-and-drop solution that allows banks and financial institutions to design and deploy custom identity verification workflows in real-time without requiring developers or technical expertise.

Yes, DataFlow allows you to create tailored verification workflows for banking, lending, fraud detection, and KYC processes. Each workflow can be customized to meet your specific business requirements and compliance needs.

With DataFlow's drag-and-drop interface, you can design, test, and deploy verification workflows in real-time - often within minutes rather than weeks or months required by traditional development approaches.

Absolutely. DataFlow is built with security by design, ensuring compliance with local and international regulations including GDPR, CCPA, and various KYC/AML requirements across African markets.

No coding or technical expertise is required. DataFlow's intuitive drag-and-drop interface is designed for business users, compliance officers, and operations teams to create sophisticated verification workflows independently.

Contact us through our website to schedule a demo of DataFlow. Our experts will show you how to build custom verification workflows and help you get started with a solution tailored to your specific needs.